How to easily order coins from your bank for personal or business needs

Ordering coins from your bank can be a convenient solution to manage your personal or business cash flow needs. Whether you’re a collector, running a small business, or in need of change for purposes such as events or fundraisers, understanding the processes and options available will help you achieve your goals efficiently. This article explores the steps involved in easily procuring coins from your bank, alongside key insights and tips that will make the experience smooth and hassle-free.

Understanding the Basics of Ordering Coins

Ordering or requesting coins from your bank isn’t as straightforward as withdrawing cash from an ATM. Banks have specific procedures for such requests, and knowing how these work can save you time and effort. Here’s a breakdown of the basic steps involved.

1. Determine Your Needs

Before contacting your bank to place an order, it’s essential to assess how many coins you need and what denominations are required. Here are some typical reasons individuals or businesses may require coin orders:

- Small Businesses: Retail or service businesses often need a sufficient supply of coins for everyday transactions.

- Events and Fundraisers: Large gatherings might necessitate a variety of coins for ticket sales or donations.

- Coin Collectors: Enthusiasts may seek specific coins or denominations for their collections.

2. Know Your Bank’s Policies

Every bank has its own set of policies when it comes to ordering coins. It’s important to familiarize yourself with these before placing an order. Common aspects to consider include:

- Minimum and maximum order sizes

- Associated fees

- Lead times – how long it takes to process your request

Contact your bank’s customer service or refer to their website for detailed information.

The Process of Ordering Coins from Your Bank

Now that you understand the basics, let’s dive into the practical steps involved in placing an order for coins. Having a systematic approach will expedite the process and ensure that you receive the correct denominations in a timely manner.

Step 1: Contacting Your Bank

The first step in ordering coins is to contact your bank. This can typically be done by:

- Visiting your local branch in person

- Calling the customer service hotline

- Using your bank’s online platform or mobile app

Whichever method you choose, be ready to provide information regarding the amounts and denominations you’re requesting.

Step 2: Placing the Order

After making contact, you’ll want to lay out your request clearly. This ensures that you get precisely what you need. When placing the order, include:

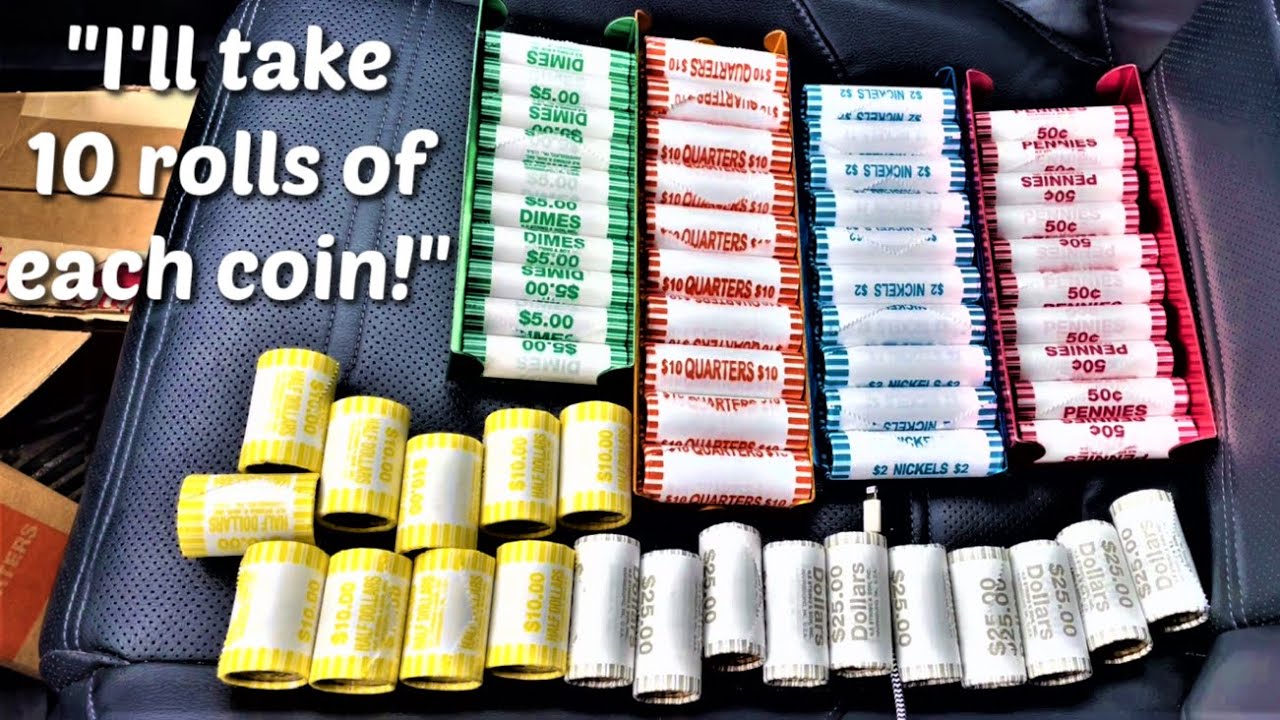

- The specific denominations of coins (e.g., pennies, nickels, dimes, quarters, and half-dollars)

- The total number of each denomination

- A preferred date for when you need the coins

Some banks may allow you to fill out a form for this purpose, especially if you are using their online services.

Step 3: Payment and Fees

Be aware that some banks may charge a fee for processing coin orders. This fee may vary based on the amount requested and the bank’s policies. Ensure you confirm payment options, which could include:

- Direct deduction from your account

- Payments via credit or debit card

- Cash payments at the branch

Understanding the cost upfront will help you avoid surprises later.

Timing and Receipt of Coins

Once your order is placed, patience is often necessary. The time it takes for banks to fill coin orders can vary. Here are some factors that can affect timing:

1. Bank’s Inventory

The availability of the specific coins you need can significantly impact how quickly you receive your order. If your bank has sufficient stock, you might get your coins within a few days. However, during peak times (like the holiday season), availability may be limited, leading to longer wait times.

2. Processing Times

Different banks have different processing times for coin orders, typically ranging from 24 hours to several days. Therefore, it’s best to place orders well in advance of when you need them to ensure you have your coins on time.

Common Reasons People Order Coins

Understanding why individuals or businesses might seek to order coins not only gives insight into their needs but can also provide context for your own orders. Here are some common reasons:

1. For Small Transactions

Many small businesses rely on having an adequate amount of coins available for daily cash transactions. Being well-prepared helps them efficiently serve their customers without delay.

2. For Charitable Causes

Coins can be crucial for fundraisers where every penny counts. Many organizations often require coins to ensure they can make change effectively during events.

3. Educational Purposes

Schools may order coins for educational workshops or money-related lessons, providing students with a hands-on experience in finance and currency.

4. Collecting Rare Coins

Coin collectors often find themselves needing specific coins which are sometimes only available through bank orders, especially if they seek rare or older coins.

Tips for Ordering Coins Efficiently

While placing an order for coins can seem straightforward, a few tips can help streamline the process and improve your experience:

1. Plan Ahead

As mentioned earlier, timing is essential. Always anticipate your coin needs in advance, especially if you have a specific date by which you need your coins.

2. Research Alternative Bank Policies

It’s wise to explore several banks if you’re not satisfied with your current bank’s offerings. Policies can vary widely, including fees and wait times, and you might find a better option nearby.

3. Keep a Record of Your Orders

Maintain a documented history of your coin orders, including the dates and amounts. This can help you keep track of what you need in the future and assist in resolving any disputes that may arise.

4. Stay Informed About Coin Demand

Coins can often be harder to come by during certain periods. For instance, more coins may be needed during holidays or tax season. By staying informed, you can plan your orders accordingly to avoid disappointments.

5. Leverage Online Services

Not all banks offer online services for coin orders, but those that do can save time. If your bank provides this option, take advantage of it for a more convenient experience.

In summary, successfully ordering coins from your bank involves understanding your needs, leveraging bank policies, and following a structured process. Each step, from assessment to placement, is vital in acquiring the necessary coins efficiently. Whether for business transactions or personal use, with the right knowledge and preparation, you can secure the coins you need without unnecessary stress.